Market Commentary | November 11th, 2024

Week in Review…

Following the highly anticipated U.S. election and rate cut decision by the Fed, last week saw equity market’s rally after the election of Donald Trump as the 47th president of the United States.

- The S&P 500 rose 4.66%, snapping a two-week negative streak

- The Dow Jones Industrial Average was up 4.61%

- The Nasdaq finished the strongest, up 5.74%

- The 10-Year Treasury yield ended the week at 4.34%

Last week saw U.S. elections take center stage as Donald Trump was reelected, winning both the electoral vote and popular vote. Additionally, Republicans won a majority in the Senate while the House is still up in the air as 19 races are still too close to call. Markets rallied in futures on early Wednesday morning, leading to a strong rally that persisted through the end of the week. In this week’s spotlight, we analyze some of the market’s reaction to Trump’s victory.

Additionally, the Federal Reserve cut its benchmark interest rate by 0.25 percentage points, bringing it to a target range of 4.50%-4.75%. This marks the second consecutive rate cut, aimed at supporting employment and addressing cooling inflation. The decision reflects the Fed’s ongoing efforts to recalibrate monetary policy to better align with current economic conditions.

Finally, the U.S. Department of Labor reported that initial unemployment claims rose slightly to 221,000 for the week ending November 2, 2024, up by 3,000 from the previous week’s revised level. This increase in claims suggests a modest uptick in layoffs, though overall levels remain historically low. The four-week moving average, which smooths out weekly volatility, decreased by 9,750 to 227,250, indicating a generally stable labor market.

Spotlight

How The Market Reacted Following the Election Results

The 2024 election was one of the closest elections in recent history, with no clear frontrunner emerging polls prior to Election Day. Uncertainty about the outcome led the market to not price in a decisive scenario for either candidate. Following the election outcome, markets reacted swiftly and positively, particularly in sectors expected to benefit from the new administration’s policies.

Equity Markets

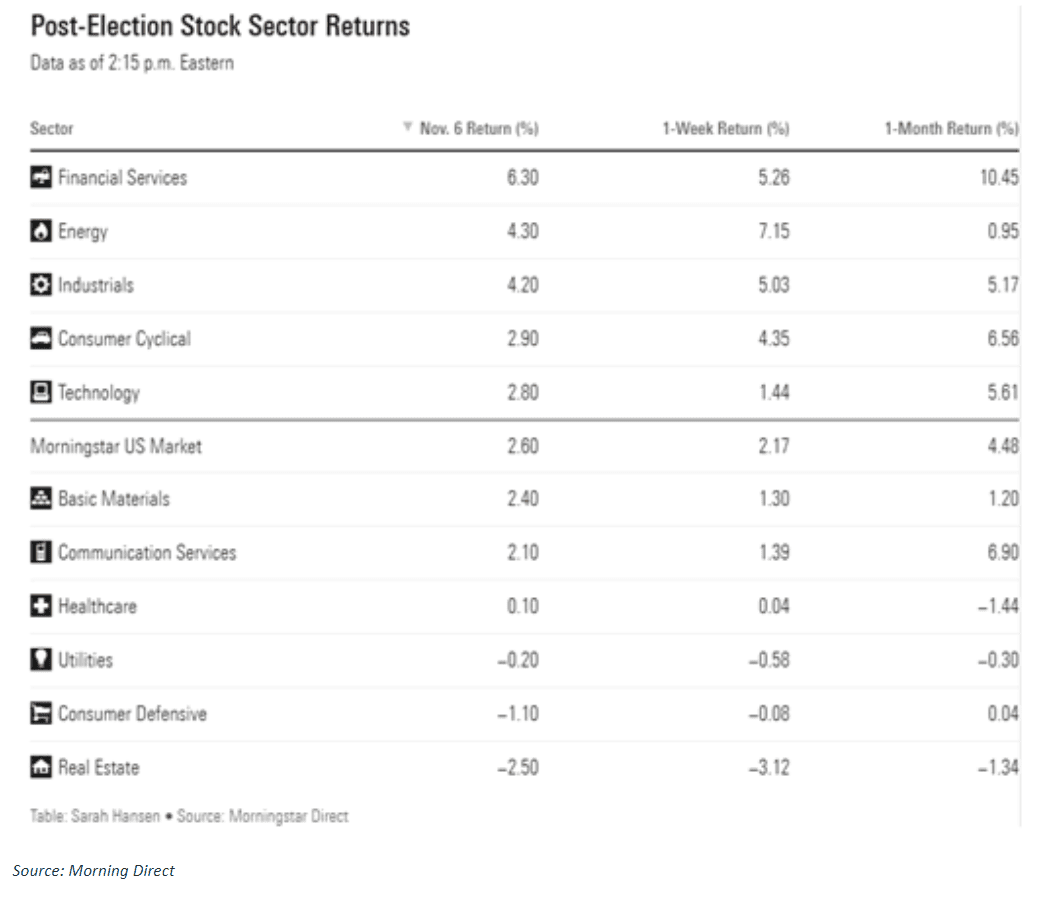

U.S. Equity Markets’ capitalization rose by $1.62 trillion the following day, the fifth-best one-day return ever. The S&P 500 rose by 2.5%, reaching an all-time high. Small cap stocks saw the largest growth, with the Russell 2000 also hitting an all-time high and rising by 5.8%. This small-cap surge is largely attributed to the perception that tariffs will protect smaller companies with primarily domestic operations.

Enthusiasm was especially pronounced in the financial services and energy sectors, which returned 6.3% and 4.3%, respectively. Investors anticipate eased regulatory pressure on banks and increased dealmaking among smaller and midsize financial institutions under a Trump administration. Bank stocks were also said to be expected to benefit from a steeper yield curve and higher long-term interest rates. The energy sector gained from expectations of fewer environmental regulations, while clean energy stocks plummeted.

Fixed Income Markets

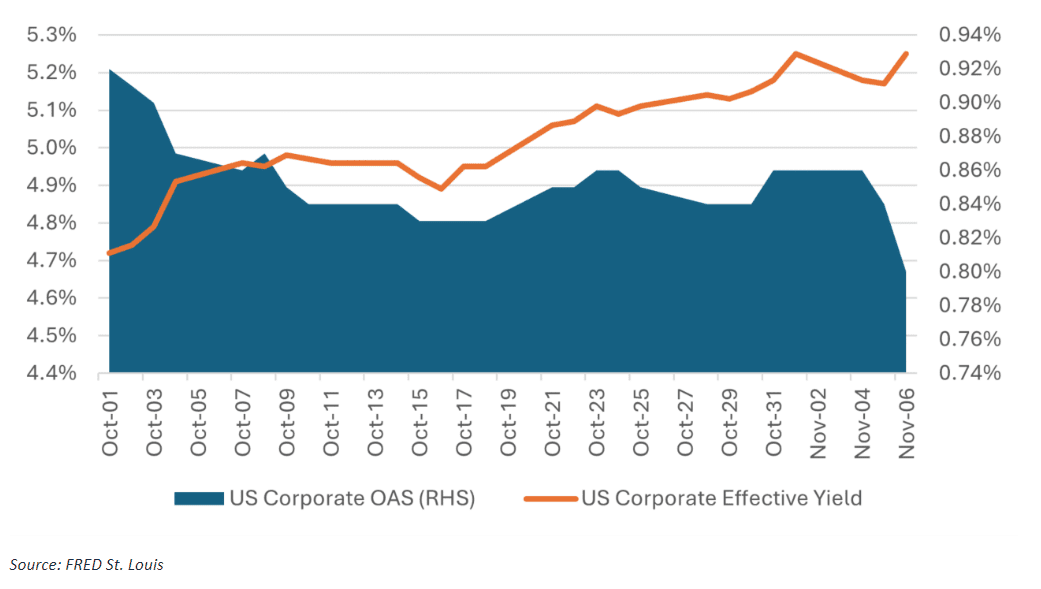

U.S. government bond yields increased due to anticipated fiscal expansion, larger deficits, and inflationary pressures. Trump’s victory had minimal impact on market expectations regarding the Federal Reserve’s cutting cycle, with projected rate cuts for 2024 and 2025 remaining unchanged. Credit spreads tightened, indicating a risk-on sentiment in the markets following the election.

Credit Spreads Tightened and Yield Rose for U.S. Corporate Bond

U.S. Dollar and Cryptocurrency

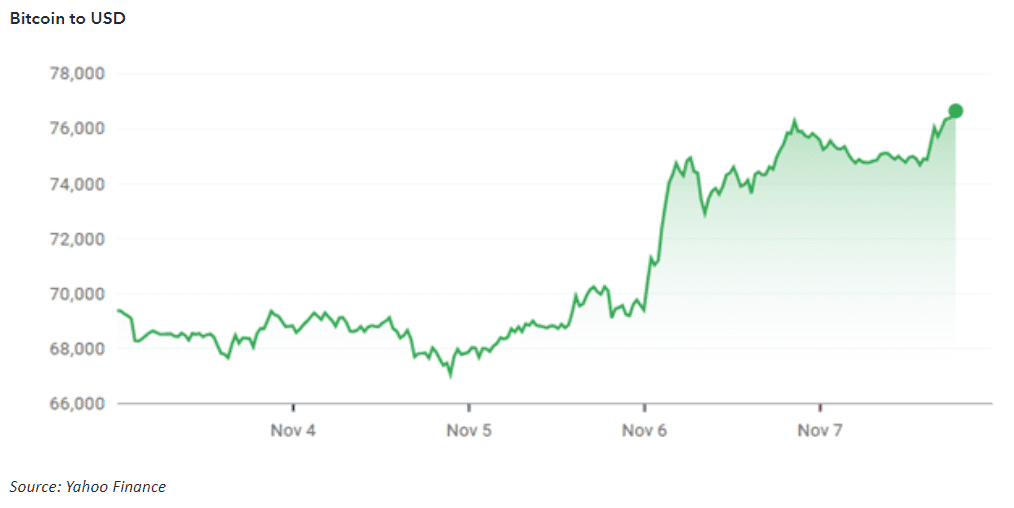

The U.S. dollar initially strengthened against other currencies but later relinquished some gains. The cryptocurrency market soared, with Bitcoin surpassing $76,000, an all-time high. This surge was generally attributed to the Republican party’s embrace of crypto and investors pricing in a less restrictive regulatory environment for the industry.

It is important to note that while elections often spark short-term volatility, markets typically return to fundamentals once the immediate effects settle. It is prudent to note that no one can predict market performance with certainty, and most strategies do not anticipate outsized moves to persist in the long term.

Week Ahead…

This week’s economic and market review centers around inflation with Consumer Price Index (CPI) data for October set to be released. Core CPI is expected to be unchanged at 0.3% month-over-month. Headline CPI is expected to be unchanged as well at 0.2% and 2.4%, for both month-over-month and year-over-year, respectively. Investors will pay close attention to these rates as concerns of possible reinflation have started to worry some market participants, which could limit the Fed’s rate cut regime.

Thursday we will get Producer Price Index (PPI) data which is expected to rise to 0.2% month-over-month from last month’s 0.0%. Crude oil inventories will also be closely watched following Trump’s election and unrest in the Middle East. Additionally, Fed Chairman Powell is expected to speak again on Thursday. Market participants will be curious what Powell has to say following CPI numbers as well as expand on last week’s comments regarding the election and working with President Trump.

Finally, we finish the week with retail sales numbers for October, which will be watched as we enter into the holiday months of the year. Core retail sales are expected to be lower, with a month-over-month change of 0.2% versus 0.5%. Headline retail sales are expected to be 0.3% versus last month’s 0.4% month-over-month.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.